HawkGold

Well-Known Member

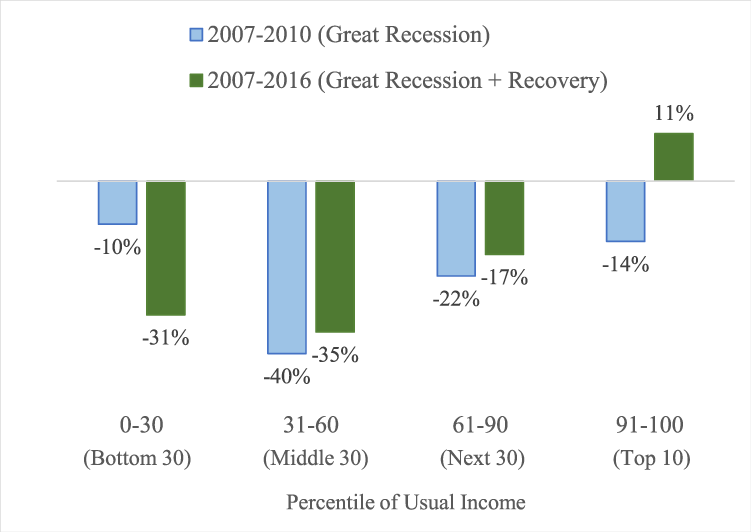

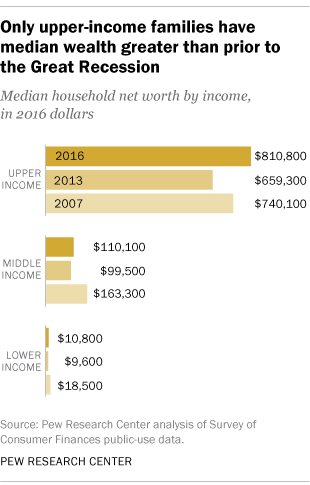

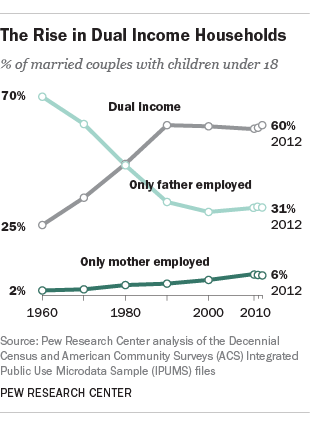

Actually there is. Monetize debt more than we do. The cost is in inflation and the rise of stocks, eventual rise in commodities after a crash, 401ks, home values at the expense of savings and defined pensions. Someday it's maybe not going to work and we get in a deflation trap. Then boom greatest depression... Maybe. When ever we reset the average people get a bit less of the pie. The alternative would be soup kitchens and homelessness. In modern terms we are somewhat like 1962: after the long bull run. The Fed pumped life support and it basically worked.There isn't enough financial assistance available to help everyone. I don't see a way any small business survives. If we quarantine for more than a couple months, I bet 75% of small businesses never open their doors again.

We did it after we left the gold standard and to reinflate following the 73-74 crisis.

In the 80s some of the reset was in military buildup spending and flooding the economy with cash leading to those awful interest rates which destroyed Farmers as commodities crashed. The 90s the S and L bailout. The internet saved us and increased economic efficiencies big time.

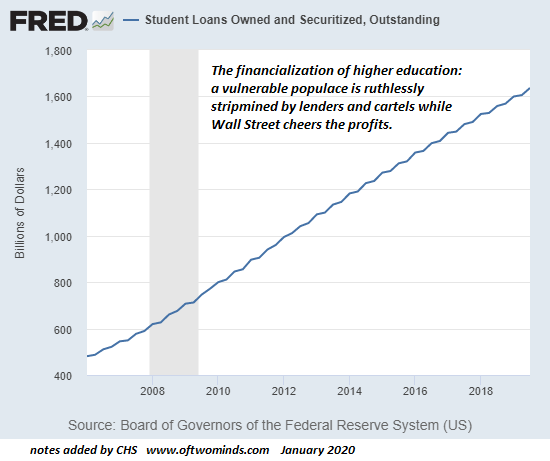

The eventual balancing of that led to the 00s crisis. We never really weaned off economic life support. It's like antibiotic or round up resistance. That's why the we first time ever have zero interest rates. Having money in the bank will cost more than losing to inflation. The Fed wants you spending or buying stocks. In 01 they pulled out the shotgun. In 08 they brought out a bazooka. They this time are/will using nukes.

It will save averages Joe's hopefully...maybe but the cost will make him a little poorer. That's the expectation. We ll see.